Hi, I’m Al Bunch, the managing Broker for Creekstone Real Estate, a Houston, Texas real estate brokerage. In today’s video we’re going to cover the sic stages of a real estate transaction process from the seller’s perspective.

There are six distinct stages of a listing that you’ll experience as a seller. Pre-listing, active listing, offer negotiation, under contract, closing, and post-closing.

Table of Contents

▼Pre-Listing Stage

First we’ll talk about the pre-listing stage.

Items covered during this stage are important as they feed into other stages. These steps will gather information that will help tailor the listing process to your specific needs, as well as identify sales strategies that will smooth out the sales process and make sure your transaction goes as smoothly as possible. The steps we talk about in this stage, assume you’ve already spoken with us over the phone or through email, and that you’ve decided that we’re the brokerage that you’d feel most comfortable and trusting with your listing

Placing a listing order

One of the first steps you’ll take is to place a listing order either through our website, by filling out a short listing order form, or by calling us directly. Either way, once you place your order, we’ll be in touch to get started with the listing paperwork.

Gather property details

We’ll start gathering details about your property that are needed for the listing number of bedrooms. Number of bathrooms, square feet. How many stories, do you have a pool, and other relevant items. We’ll also send you some forms to complete like an exclusion worksheet to capture any items that you don’t want to include with the sale of your, a seller’s disclosure form, and a property information sheet.

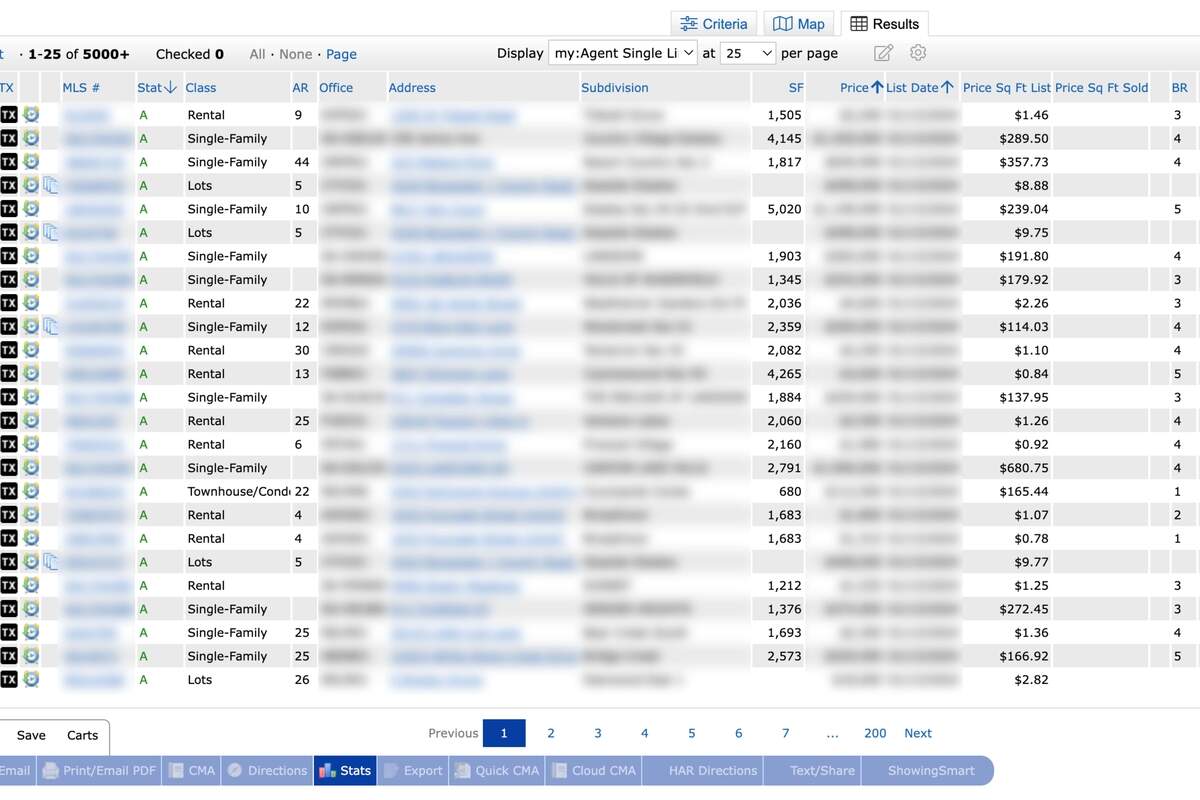

Sales goals and CMA

Once those forms are completed, if we haven’t already, we’ll discuss your sales goals with you to find out if you are price or time sensitive, then we’ll review recent sales in your neighborhood and generate a CMA or comparable market analysis to help you gauge how much your home might sell for based on the initial paperwork.

🎁 Fill out our short form and get a free CMA today!

Additional forms & Go-live date

Based on our initial conversation, if there are any additional forms that need to be completed, we’ll have you fill those out. Forms you might see at this step would be things like a lead based paint disclosure for homes built before 1978, property specific paperwork for condos, or paperwork that’s specific to rural or coastal properties. Once we’ve completed the pre-listing paperwork and discussed your sales goals with you, we usually have a good idea of when it might make sense for your listing to go active in MLS, but we always want to help you make informed decisions, so we’ll suggest a few good start dates, get your feedback, and agree on a target go live date with you.

Active Listing Stage

In the active listing stage we’ll generate a listing agreement, coordinate with our vendors, and add your property to MLS using all the information you provided from the pre-listing stage.

The listing agreement will cover things like the initial list price, buyer’s agent commission, exclusions you listed on your exclusion worksheet. It will also outline our commission structure in writing so there are no questions and we’ll point this out to you and review/answer and questions you have before gathering signatures.

Photos

Once the listing agreements been signed, we’ll get you on the schedule for professional photos to be taken of your property. Depending on the time of year, these can usually be completed within a few days.

Once the photos come back, we’ll review them and pick the most suitable ones to add your listing. We’ll also provide you with a complete set as well. At the same time, we’ll get you on the schedule to have a yard sign and Supra electronic lockbox installed. If you’re in a condo or have an HOA that doesn’t allow you to have yard signs we’ll just schedule the lockbox install.

Sign & Lockbox

The Supra electronic lockbox will be installed on the front door or other suitable location and the key carrier will be left outside the lock box so you can place your keys inside.

Add your listing to MLS

We’ll also enter your listing into MLS and begin adding the finishing touches to the listing things like adding the photos, adding your sellers disclosure, and setting the listing up in the showing scheduling service.

Review & Approve

Once your listing entry is complete, we’ll send you a PDF copy to review and approve. After you’ve approved your listing we’ll get it on the schedule for a go-live date.

Setting your listing to Active

We’ll schedule your listing to go live on the agreed on date. Once live, listings will begin showing up in MLS and on HAR.com within a few of hours. After being set to active syndicated versions of your listing can take anywhere from 24 hours up to seven days for your listing to become. On sites like Realtor.com, Zillow, Trulia, Redfin, and other mid-market independent websites. After your listing goes live we’ll begin monitoring market response.

Monitor for market response

We’ll check for things like the number of showing scheduled, general level of interest in the feedback forms from showing, requests for information by buyer’s agents and metrics for things like number of times your property shows up in curated MLS searches. Depending on the sales velocity in your area, we usually monitor activity for at least two weeks before trying to adjust anything with the listing and usually up to 30 days or more. If you’re not getting the response you expect we can always talk about ideas to help increase traffic.

Offer Negotiation

The offer negotiation stage begins once you’ve received your first offer.

Offer presentation

As we receive offers, we’ll present them to you, and while some sellers prefer not to see low-ball offers, we’re still required to present every offer to you regardless of the format of the offer or the face value on the contract.

As we present received offers to you, we’ll review the offers and point out anything we notice, as well as answer any questions you may have and try and help you make an informed decision. While we’re pointing out things that are relevant to you from a sales perspective, we’ll also be making notes about technical errors that will need to be corrected on the contract before acceptance.

Once you’ve settled on an offer, or two, or three, we’ll help you formulate a response or a counter offer. If none of the received offers are suitable, there’s a myriad of choices ranging from choosing not to respond at all to sending a counter offer, or even sending a TAR-1926, which is an “Invitation from Sellers to Buyers To Submit a New Offer.” Although the last option is very rarely used it can be effective given the right scenario.

When formulating a counter offer there are quite a few tactics and strategies that can be used to help gain an edge or eliminate possible future issues within a transaction. Negotiation is one of the most interesting parts of the transaction and we’ll do our best to help you navigate through this stage with as little stress as possible.

Offer acceptance

Once both parties have come to an agreement and the contract has been adjusted to match what was agreed on as well as corrected to fix technical errors. We’ll gather the paperwork, set it up and DocuSign and send it to you for eSignature. This moves us to the next stage.

Under Contract

Now that you’re under contract, we’ll start coordinating with and working with title companies, lenders, the buyer’s agent, inspectors, appraisers, surveyors, and other vendors that take part in the closing process.

Delivering the contract to title

When the contract is signed and the execution dates have been filled in, we’ll deliver the completed contract to the title company. They’ll begin doing their title search, working on tax certifications, reviewing the property for title insurance underwriting, contacting your lender to get final payoff amounts, working with the buyer’s lender to get closing instructions, and a whole host of other things.

Earnest Money Deposit and Option Fee Delivery

The next two most important items we watch for once the contract has been delivered to title is for the buyers to deliver their earnest money deposit and the option fee to title within the timeframe defined in the contract. Once title receives the earnest money deposit and the option fee they’ll issue a receipt showing both the amount received and when it was received. This is a key milestone that’s important to every contract.

Inspections

The buyers will typically already have an inspector lined up to perform their inspection, and will schedule them with you through the showing scheduling service. General inspections take around four to five hours to complete, but for large properties could take up to a whole day.

Occasionally there’ll be secondary inspections if the general inspection identifies an area of concern for the buyer, or if the general inspector isn’t qualified to inspect certain systems such as foundations, pools, electrical systems, or other major systems within a property.

Buyers, don’t typically accompany the inspector for a full inspection, but they will occasionally show up during the last 20 to 30 minutes for a summary report before the official reports delivered.

Once the inspection report comes back, the buyers will review it with their agent and determine whether there’s anything they want to address in repair negotiations.

Depending on the property condition, repair negotiations could either be non-existent or very extensive, and there are many possible paths through this step so there’s no simple way to cover it in a single video.

We’ll help you negotiate the repairs and then capture the outcome of those negotiations on an amendment for everyone to sign that will then become part of the contract.

Appraisal

If the buyer is using a lender to purchase your property and depending on the terms of the buyer’s loan, there will typically be an appraisal requirement.

Most appraisals are scheduled to be completed after repair negotiations have completed and after the option period expires. This is typically one of the last major hurdles sellers experience.

It’s worth noting that in a rapidly appreciating market where you’re pushing the sale price envelope of the property, the appraisal can occasionally make or break a deal but usually they come and go without much fanfare.

Survey

Surveys are also almost always a requirement when there’s a lender involved ,and if you don’t have a previous survey or at least a previous survey that you can use, depending on the terms of the contract, a survey will be ordered, completed and delivered in time for closing.

If you do have a survey from when you previously purchased your property and you’ve reached out to the survey company to receive approval to reuse this, we should already have a copy of your survey and a notarized T-47 on file. Those two items together will normally satisfy the lender survey requirement.

Closing Stage

Once the buyer and the property have both made it successfully through underwriting, repairs have been completed, the appraisal and survey are complete and satisfactory, any lender payoffs for your mortgage have been ordered, the buyer’s lender has delivered closing instructions to title, you’ve packed and scheduled your move, and you’ve scheduled your utility disconnects, you’re in the home stretch.

The last week of a contract almost always sees a flurry of activity where everyone working on the transaction as well as those involved in the transaction are all working towards meeting the closing date.

Final Walkthrough

Buyers and their agents will schedule a final walkthrough, usually as close to the closing date as possible to make sure negotiated repairs have been completed, and to take one last look at the property before closing.

Scheduling Closing

Title will reach out to you to schedule your closing time. Typically this happens once title receives a clear to close indication from the buyer’s lender. Depending on the efficiency of the buyer’s lender this can happen as early as a week before the agreed on closing or even as late as a day before closing.

We do our best to make sure closing happens on the date all parties agreed to, however, occasionally this date needs to be adjusted, and if it does we’ll help you with that step if it comes up.

Review Closing Disclosure

Within about three business days prior to closing date we’ll reach out to title to request a preliminary closing disclosure and review it for obvious errors.

We’re looking for things like incorrect commission amounts, missing credits for option fee and earnest money deposit, incorrect sale price, and missing repair credits.

Usually this preliminary closing disclosure will not have your property specific details on it like final prorated property tax amount, prorated HOA dues, or your loan payoff amounts, these values are all are all calculated to the day.

Because our preliminary copy won’t have these amounts, and because we also can’t verify things like your loan balance. We suggest you review the closing disclosure carefully at the closing table and get the escrow officer to make a correction before you sign the closing paperwork if any errors are discovered.

Utility Disconnects

As you near closing, you’ll want to schedule your utility disconnects and cancel service providers. Lawn service, electricity, water, cable, internet, satellite, etc.

Make sure you leave the pool pump running and leave your pool maintenance equipment with the property as the pool maintenance equipment is considered part of the sale unless specifically excluded.

Closing Day

On the day of closing, remember to bring one full set of keys, alarm codes, access codes, key fobs, and service passwords with you to closing to hand over to either the escrow officer or the buyer once closing has concluded.

Once title has received good funds and certifies closing the keys can then be released to the buyers or the buyer’s agent. You’re free to leave the keys with your escrow officer for the buyers to pick up once the property closes and funds. Your escrow officer will review your closing paperwork with you as you sign.

The stack of paperwork for sellers is typically much smaller than the stack for buyers and usually doesn’t take too long to complete.

If you’ve sold a property before, you probably know exactly what to expect by the time you reach the closing table. Nevertheless, we are still available by email or phone on the day of your closing should you have any questions. We’re usually aware of your closing time and will keep an eye out for any last minute items.

Post-Closing

In the post-closing stage, you’ve signed paperwork, left a set of keys with title, you’re completely moved out of the property, and you’re just waiting for the buyers to sign their paperwork and their lender to wire funds to title, and then for title to wire your portion of closing proceeds to you.

Once both parties sign their paperwork and the buyer’s lender has wired good funds to title, title will certify closing, and send out final closing paperwork to all involved parties.

This is usually something buyers and sellers don’t notice, but occasionally a buyer’s lender will initiate a wire transfer late on Friday and the funds won’t show up in your account until Monday. This leaves the buyers without access to the property over the weekend and sellers are left wondering where their proceeds are. A quick call to title on Monday morning will usually get you an exact status.

Marking your property as SOLD

Once title certifies, the closing we’ll move your property from pending to closed in MLS, and depending on how smoothly the closing seems to be going, we may have already scheduled to have the sign and lockbox removed on the day after closing, but if the closing date looks like it might adjust at the last minute, we will wait to schedule the removal until closing is actually completed.

The sign and lockbox are usually picked up within one to three days after closing, if not sooner.

Congratulations!!

Congratulations, you’ve completed the sale of your property, and we have definitely enjoyed working with you.

If you’ve got more questions about the listing process, please call or email and we’ll be happy to go over it in more detail.

Reviews

We really enjoy working with our clients, even through the occasional stressful situations, and we hope you’ve enjoyed working with us too. Here’s our shameless plug - if you had a 5 star experience with us we would really appreciate you telling others about your experience. If you had less than a 5 star experience, we can’t time travel, but we’re always open to feedback so please reach out and tell us what we can do to improve.