When is a Seller’s Disclosure Notice required in Texas?

Sales of residential property in the state of Texas usually require the seller to furnish to the buyer a Seller’s Disclosure of Property Condition (TREC OP-H) except under very specific conditions outlined in section 5.008 portion of the Texas Property Code.

Even though the Texas REALTORS® Seller’s Disclosure Notice (TXR 1406) and the TREC Seller’s Disclosure Notice (TREC OP-H) provide places for a buyer to sign on the last page, a buyer does not have to sign or initial at all.

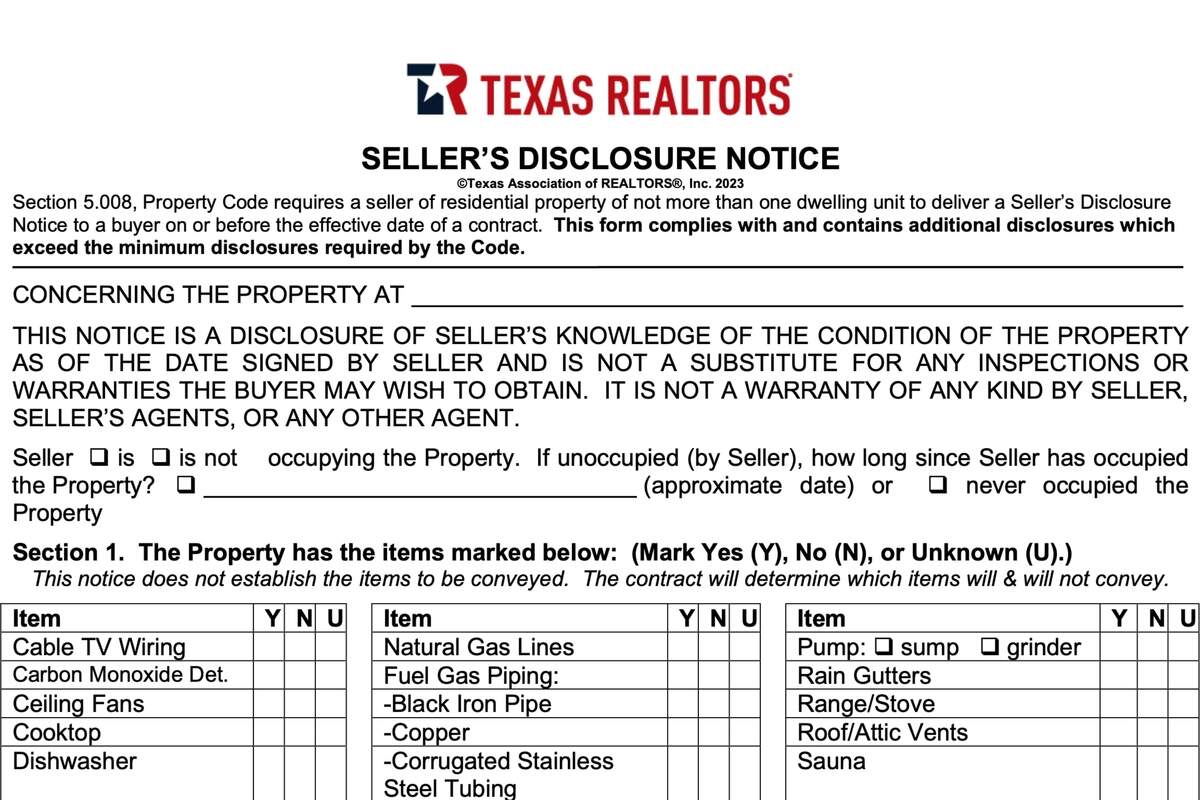

Texas Seller’s Disclosure Notice

The two most common reasons I hear for why a Seller doesn’t believe they need to furnish a completed copy of this form to a buyer is that the seller has never lived in the property, as in the case of a Landlord, or the seller is an Executor/Executrix for the estate for a decedent with whom they were related to or were friends with.

In both cases the seller usually has knowledge of the property condition and should disclose anything they know on the Seller’s Disclosure of Property Condition form. At the very beginning of the form, there is a section for you to state that you are not occupying the property and/or that you have never occupied the property. You can explain on the form what you do and do not know about the property.

Seller x is x is not occupying the Property. If unoccupied (by Seller), how long since Seller has occupied the Property? x (approximate date) or x never occupied the Property

Sec. 5.008 Sellers’ Disclosure of Property Condition

You can read the full section 5.008 portion of the property code on the Texas Constitution and Statutes website.

Section 5.008(e) spells out the exemptions for giving a Seller’s Disclosure of Property Condition.

(e) This section does not apply to a transfer:

(1) pursuant to a court order or foreclosure sale;

(2) by a trustee in bankruptcy;

(3) to a mortgagee by a mortgagor or successor in interest, or to a beneficiary of a deed of trust by a trustor or successor in interest;

(4) by a mortgagee or a beneficiary under a deed of trust who has acquired the real property at a sale conducted pursuant to a power of sale under a deed of trust or a sale pursuant to a court ordered foreclosure or has acquired the real property by a deed in lieu of foreclosure;

(5) by a fiduciary in the course of the administration of a decedent’s estate, guardianship, conservatorship, or trust;

(6) from one co-owner to one or more other co-owners;

(7) made to a spouse or to a person or persons in the lineal line of consanguinity of one or more of the transferors;

(8) between spouses resulting from a decree of dissolution of marriage or a decree of legal separation or from a property settlement agreement incidental to such a decree;

(9) to or from any governmental entity;

(10) of a new residence of not more than one dwelling unit which has not previously been occupied for residential purposes; or

(11) of real property where the value of any dwelling does not exceed five percent of the value of the property.

Checking Item 7.B (3) on the Residential Resale contract (purchase agreement), stating that you are not required to furnish notice under Texas Property Code when you are required to furnish notice could give the buyer a valid reason to terminate the purchase agreement outside of their option period.

(3)The Seller is not required to furnish the notice under the Texas Property Code.

Make sure you’re really not required to supply a Seller’s Disclosure before checking that box.

Update February 2, 2023

What changed? All sellers must now disclose the type of pipe used for their gas supply lines. Black iron pipe, copper, or corrugated stainless steep (CSST).

I’m a seller, how do I know what type of piping I have? If you don’t know you can check “unknown” on the Seller’s Disclosure notice, however, if you’ve had your home inspected by a licensed inspector any in 2022 and beyond, indicationg the type of gas (fuel) piping is now a requirement on the inspection report you received.

TREC Provides the minimum required Seller’s Disclosure of Property Condition](https://www.trec.texas.gov/sites/default/files/pdf-forms/55-0.pdf) form on their website, free for public download or review.

Use of the revised form becomes a requirement on September 1, 2023.

Update August 7, 2019

The 86th Texas Legislature passed two bills that added questions to the Seller’s Disclosure Notice (TXR 1406) specifically regarding flooding, such as whether the seller’s property is located wholly or partly in a 500-year floodplain, whether the seller has ever filed a claim for flood damage, and questions about the nature of any flooding that occurred on the property.

Which Transactions Need to Use the Revised Form? The revised version of the Seller’s Disclosure Notice becomes mandatory for use transactions when the sales contract is executed on or after Sept. 1, 2019. It may also be used on a voluntary basis for transactions where the contract is executed prior to that date.

FAQ

How can I quickly tell which version of the TREC Seller’s Disclosure form I’m using?

In the top right corner of the first page, there is a date that indicates which version of the document you’re looking at.

I’m buying a property and we’re 9 days from closing and I still haven’t received the Seller’s Disclosure notice, can I terminate the contract?

Yes. The 1-4 Family Residential Resale Contract, in paragraph 7B2 has a provision that allows you to “…terminate this contract at any time prior to the closing and the earnest money will be refunded…” and even if the Seller does deliver notice, you may “…terminate this contract for any reason within 7 days after Buyer receives the Notice or prior to the closing, whichever first occurs, and the earnest money will be refunded to Buyer.”

For a broader perspective on real estate transactions, take a look at our article on Real Estate Transaction from the Seller’s Perspective.